With The investment and construction of China in the construction of the display industry chain in recent years, China has become one of the world's largest panel producers, especially in the LCD panel industry, China is the leader.

In terms of revenue, China's panels accounted for 41.5% of the global market in 2021, outperforming the former hegemon South Korea by 33.2%. Specifically, in terms of LCD panels, Chinese manufacturers have won 50.7% of the global share. South Korea continues to lead in the field of OLED panels, with a global share of 82.8% in 2021, but the OLED share of Chinese companies has increased rapidly.

However, being able to achieve such a large market share is inseparable from the long-term expansion and bargaining of domestic panel companies. Before the epidemic, the price of panels was almost at a low level, and many small panel companies survived in the cracks of large enterprises, but with the continuous decline in panel prices, many panel companies faced the situation of not making money or even losing money.

The LCD (liquid crystal) TV panel production capacity of Chinese factories continues to open up, and the supply floods the world, resulting in frequent sales of LCD prices.

According to Wit Display news, the first four months including North America and other major TV sales recession, coupled with inventory problems emerged, the decline in TV panels in May intensified, TrendForce senior research vice president Qiu Yubin said that TV panels below 55 inches have a single month of decline of 2 to 5 US dollars.

Although many sizes have come to cash costs, but the terminal demand is not good, the panel factory production reduction is limited, and the pressure of oversupply is still large, resulting in an expansion of the price decline in May. In the second quarter, large-size panels continued to decline, and panel manufacturers may lose money in a single month, and the operating pressure has increased significantly.

South Korea Economic Daily reported on the 2nd, insiders revealed that starting this month, LGD's South Korea Paju plant and China's Guangzhou plant will cut the LCD assembly production line of glass substrate production, the company's LCD TV panel output in the second half of the year will be more than 10% lower than the first half of the year.

Chinese factories mass production, at a very competitive price to seize the market, so that the global LCD TV panel quotation continued to decline, LGD defeated, decided to significantly reduce production. Prior to this, another Korean factory, Samsung Display, had announced that it would exit the LCD business at the end of 2022 due to deteriorating profits. There are also Mitsubishi, Panasonic and other companies in the last year also reported the reduction or suspension of production of their LCD panel production line.

Samsung, LGD, Panasonic and other enterprises with LCD panel production lines have sold and stopped production, which has made China a large country in LCD panel shipments. These former panel giants chose to buy LCD panels from China after a large number of productions or production cuts, which also made THE LCD panel production capacity and supply closer to China's head brand.

In fact, since the rise of China's LCD panel production, it has a very big impact on the pattern of global LCD panel supply. In particular, the head panel enterprises led by BOE and Huaxing Optoelectronics have grown rapidly in shipments in recent years. BoE, Huaxing Optoelectronics, Huike three head manufacturers in the first half of 2021 LCD TV panel shipment area accounted for 50.9% of the total global shipment area in the current period.

According to data from LOTTO Technology (RUNTO), in 2021, the total shipments of land-based panel factories reached 158 million pieces, accounting for 62%, a new historical high, an increase of 7 percentage points over 2020. The share growth comes not only from acquisitions, but also from the expansion of the mainland's production capacity itself, and the center of gravity of lcd panels has shifted to China.

Although it seems that China's LCD industry chain is growing, the industry is also facing many problems.

First of all, the LCD TV dividend has almost disappeared. Although now in the entire TV field, the sales volume and volume of LCD TV are very large, accounting for more than 80% of the entire TV shipments. Although the volume is large, but we all know that the LCD panel or TV does not make money or even lose money, for the panel enterprises, the lcd panel dividend has almost disappeared.

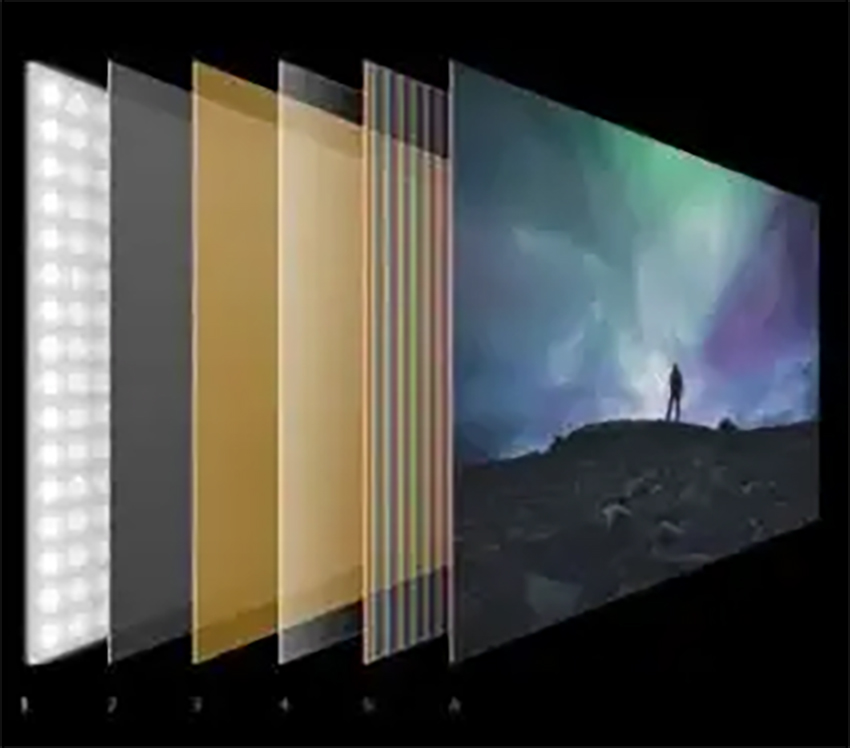

Secondly, innovative display technology is chased and blocked. As mentioned earlier, Samsung, LGD and other head panel companies choose to stop production or reduce lcd panels, not making money or losses is on the one hand, on the other hand, it is hoped to put more financial resources and manpower into the production of innovative display technology panels, such as OLED, QD-OLED and QLED.

Under the premise of the continuous growth of these innovative display technologies, it is a dimensionality reduction blow for LCD TVs or industrial chains, and the production space of LCD panels is constantly squeezed, which is also a big challenge for China's LCD panel enterprises.

In general, China's LCD panel industry chain is growing, but competition and pressure will also be increasing.

Post time: May-30-2022